how much is a million dollar life insurance policy for a 70 year old woman

How Much Is A Half Million Dollar Life Insurance Policy. A million-dollar life insurance policy covers both needs.

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

By comparison you might be able to get a million-dollar term policy.

. He can save money and still maintain good life insurance protection by buying the following policies. A one million dollar term life insurance policy may seem excessive but there are many reasons a person may need a 1 million dollar policy. A 300000 life insurance policy is usually enough for most middle class families.

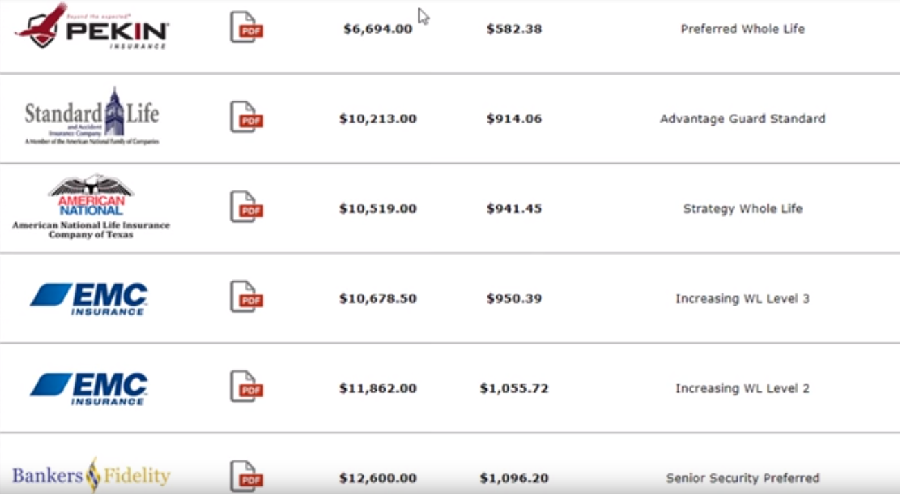

70 year old woman. 30-year terms cost more. Taken over the 15 insurance companies shown above the average cost for 20 years of coverage was.

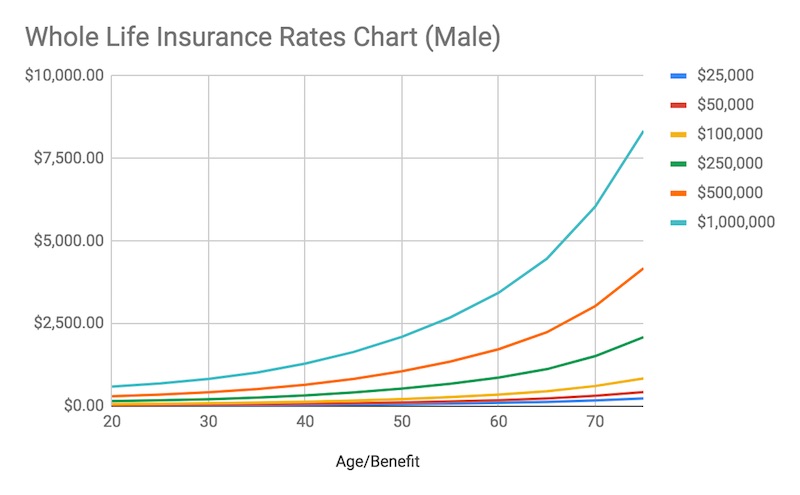

A million-dollar whole life policy often costs 800 a month or more even if you purchase the policy young. Shorter-term policies will cost less. Million-dollar life insurance policies are quite affordable depending on your policy length of policy age and health.

A healthy non-smoking 30-year-old woman can get 1 million coverage for as little as 34month with a 10-year term life policy. 72 year old female. So for example if you make 100000 dollars per year.

465 70 votes The cost of a 1000000 life insurance policy for a 10-year term is 3205 per month on average. How much is a million dollar life insurance a month. How Much Coverage Should I Get.

The average cost of a term life insurance policy for a healthy 40 year old is 24 month for a woman and 29 month for a man for a 500000 20-year term policy. Here is an illustration example of a blended whole life policy. 73 year old female.

50 per month or 12000 in. 70 year old man. In general the younger and healthier you are the more affordable your rates will be.

Financial planners recommend you should get 5 to 10 times your yearly salary in life insurance. For example a 25-year-old non-smoking female might pay 3345 per month for a 20-year. The two exceptions for 4 million of life insurance and 5 million of life insurance is for the 80 year old which is a guaranteed universal life quote which had to be quoted since.

A 10-year 2000000 life insurance policy for 32 per month. 71 year old female. 10032022 - These typical.

30 per month or 7200 in total. 400000 Mortgage Balance 400000 Mortgage Life Insurance. If you prefer a 20-year plan youll pay an average monthly.

Rule of thumb is that you should get 5 to 10 times the amount of your yearly salary in life insurance. As you can see blending a whole life policy with. 200000 Income x 3 years 600000 Life Insurance.

A one million dollar life insurance policy may seem like a lot at first blush but when you think about how far a dollar can go nowadays 1000000 of life insurance coverage.

Why Whole Life Insurance Is A Bad Investment White Coat Investor

Who Needs A Million Dollar Life Insurance Policy

Cost Of One Million Dollar Life Insurance Policy

Best Term Life Insurance Of November 2022 Forbes Advisor

What Is A 10 Year Term Life Insurance Policy

What To Know About Cashing Out Life Insurance While Alive

How Much Is Life Insurance Average Costs Progressive

Term Life Insurance And Death Probability Video Khan Academy

Whole Life Insurance Rates Comparison Charts Rates For 2022

How Much Does Life Insurance Cost For A 70 Year Old 2022

2 Million Dollar Life Insurance Is It Enough For You

10 Million Dollars The Ideal Net Worth Amount For Retirement

Buy A Million Dollar Life Insurance Policy For Cheap From 15 Month

Retirees It S Not Too Late To Buy Life Insurance Kiplinger

Life Insurance Rates Term Whole How Much In 2022 Finder Com

10 Million Dollar Life Insurance Policy Cost Policymutual Com

How Much Does A 1 000 000 Life Insurance Policy Cost

How To Buy A 1 Million Life Insurance Policy And When You Need It